How does withco define “small business?”

At withco, we measure our success based on our ability to impact the small business community. Our core mission is to help small business owners become property owners so that they can ensure their longevity and build the generational wealth that’s become more and more elusive in today’s market.

But according to the government-run Small Business Administration, there are over 30 million small businesses across the U.S. based on their definition of the term. While we’d love to help as many small businesses access the capital they need to purchase their commercial property, there is a set criteria that we operate under to ensure our partnerships result in a win-win scenario on all sides.

Below, we’ll break down just how withco defines “small business” and who actually qualifies to participate in our signature lease-to-own model.

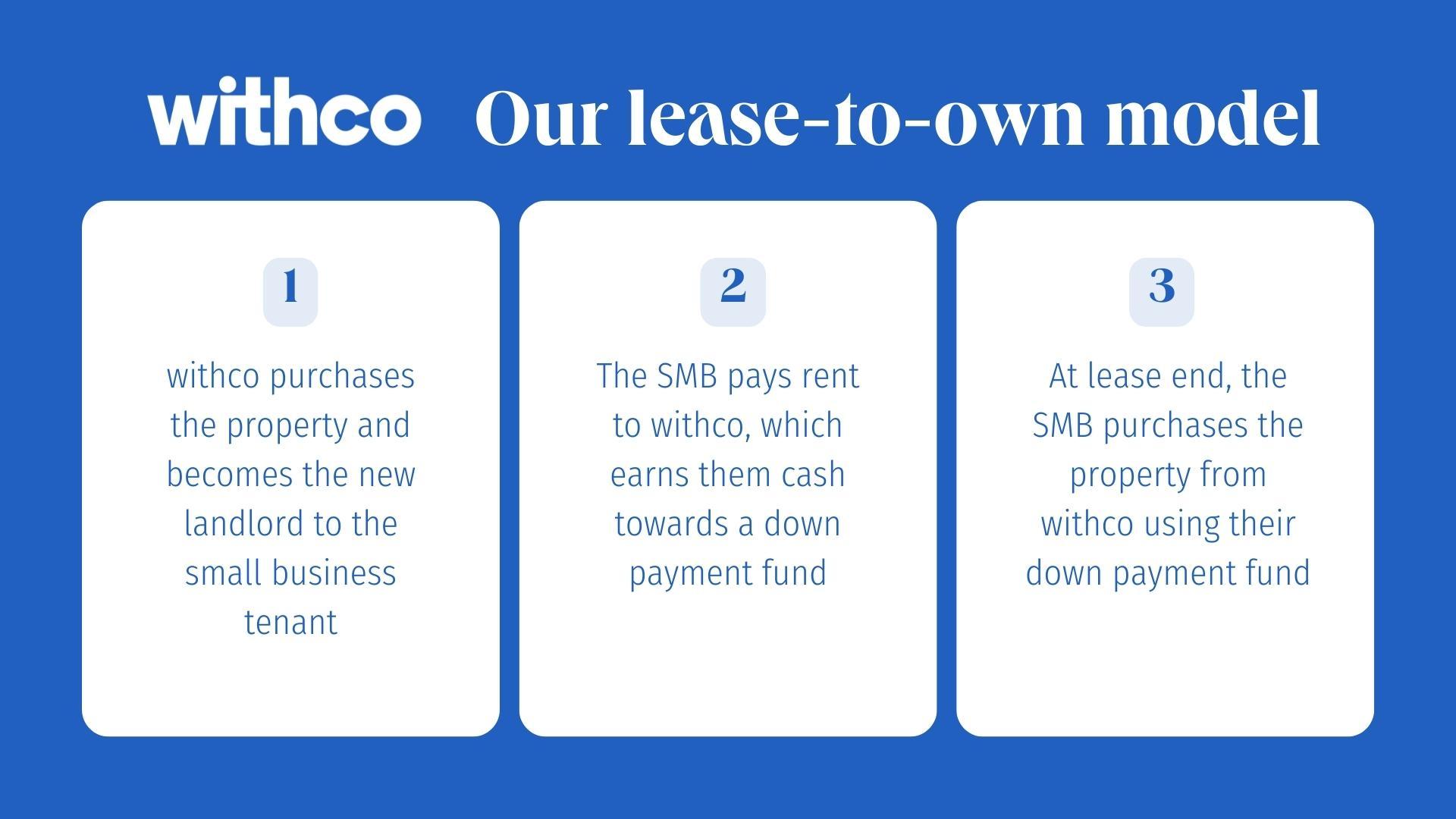

To understand the kind of small businesses we work with, it’s important to understand how withco’s lease-to-own model works. Essentially, withco is a real estate investor who purchases properties that are occupied by small businesses. We then lease the property to the small business owners.

In this way, we operate much like a traditional landlord, only everytime the small business pays rent to us, they earn a percentage of the downpayment they need to purchase the property from us at the end of our five-year lease term.

Of course, to ensure that the small business can successfully purchase the property from us at the end of the lease, the business must undergo a substantial underwriting process and meet specific criteria.

The #1 qualification we use to determine eligibility for partnership with a small business is whether or not the business would qualify for an SBA mortgage at the end of our lease term. This is because our end goal is to set our partners up with a SBA mortgage at the end of their five-year withco lease—though this isn’t the only financing option. Small business owners are able to choose the lender that works best for them.

How a beloved restaurant in Jefferson, GA, found their path to property ownership.

Eligibility for SBA loan requirements vary drastically by industry, but consider both the business’s revenue and number of employees. We will only partner with businesses, including franchisees, that are eligible for a SBA loan at the end of their lease term.

SBA guidelines stipulate that the business must:

There are certain types of businesses that the SBA will not offer financing to, and unfortunately this means we won’t be able to partner with these types of businesses. Restricted industries include:

We are currently only focused on investing in properties that are occupied by a single small business tenant. Thus, the small business tenants must intend to stay in the property long term and/or have the desire to own their property.

The businesses must also be in good financial standing to successfully make future mortgage payments. This will be determined by our streamlined yet rigorous underwriting process and means that business must be able to share up-to-date financials with withco.

withco is happy to work with franchises in certain cases. For franchisees, we use the number of locations to inform whether they qualify: We are open to partnering with owners of multiple locations, but are currently prioritizing those who own and operate fewer locations.

Interested in working with us? This is just an outline of how we define small businesses, but we’re always happy to discuss if a tenant fits our definition. We’re looking to partner with your favorite mom n’ pop shop or local franchisee. Here’s a few recent small businesses we’ve partnered with: